After I finished posting the “Rain” video this morning, another video was suggested to me as something I might enjoy.

The YouTube headline got my attention –

“Inside a $40.5M Estate With a “Batcave” Garage | On The Market | Architectural Digest”

The video was everything I hoped for on a rainy Saturday morning.

Sometimes you just have to appreciate the different facets of our business and how far some people are willing to go when it comes to creating custom luxury homes.

I hope you enjoy the video and appreciate the work that goes into creating these luxury showcase homes as much as I do.

But even more than that – I hope you realize that not everyone has stopped working.

Homes are being listed, bought and sold – RIGHT NOW – all across the country. And that includes our back yards here in the DMV area.

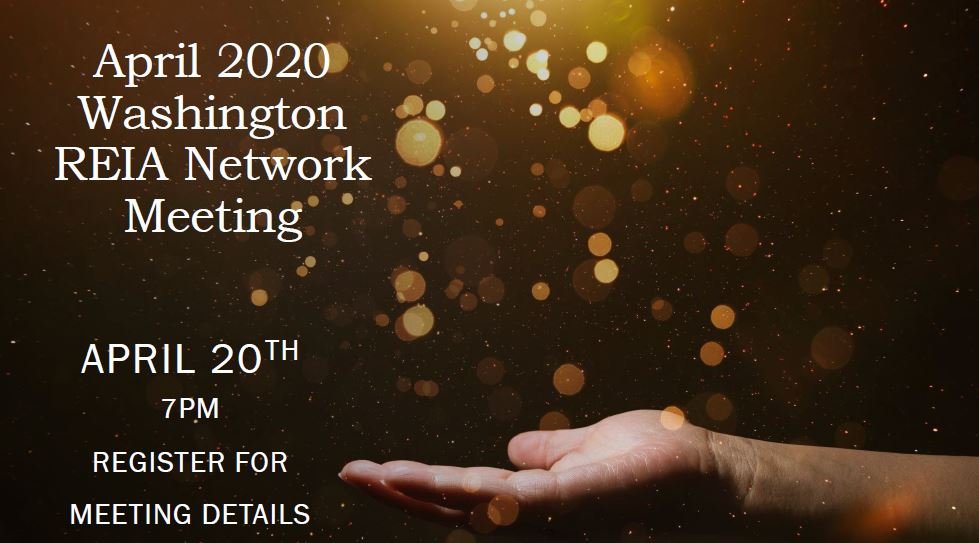

This is a time for NETWORKING, RESOURCES, BELIEF AND EDUCATION.

All of them are Pillars of our WREIA investor community.

Join us this month ONLINE for a great time of learning from other WREIA Members that are still working hard in this strange time.

We have assembled a few of our members and are going to be discussing what is

going on in the marketplace and how they continue to keep moving forward.

We will get perspectives from a Realtor, Investor and a Landlord.

There are a lot of questions right now…

- Are you still looking for opportunities?

- On your current projects are you still able to get some renovation work done

- Are you seeing some flexibility on price with sellers and wholesalers?

- Are banks, private lenders still lending money?

- Are sellers scared to show houses?

- Are you seeing listings removed from Bright MLS?

- How is buyer traffic?

- Are you seeing renters struggle to pay rent?

- Do you think now is the time to search for more long- term rental opportunities?

Do not miss this VERY IMPORTANT ONLINE meeting.

Register Here – Monday April 20, 2020 at 7pm Eastern Time

We will send you a link to join us online once registered.

Register for the Monday night WREIA meeting now.

Stay safe and stay healthy,

John Peterson